Three Smart Ways to Get A Loan Even When Your Credit is Messy

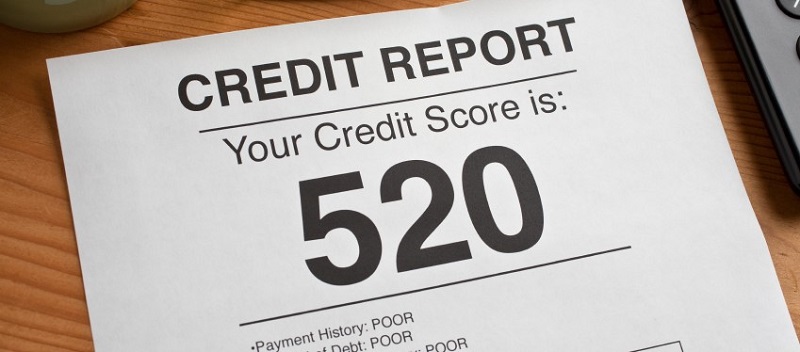

Your credit score plays an important part in your financial health. The credit score determines the ease with which you can access loans and the amount of interest payable on each loan. The credit score determines the kind of leases you can get when searching for an apartment, your credit score could affect your mortgage, and your ability to secure employment in some industries could also be hinged on the credit score.

However, many people often find themselves battling with poor or bad credit – sometimes it is because they made poor financial choices; other times, it is because of factors beyond their control. Irrespective of the reasons behind your bad credit, you can still rewrite your credit history. This post provides insight into three ways to get a loan even if your credit is messy.

Find loans the old (or not so old) fashioned way

If your creditworthiness is messed up, you can still manage to get loans with bad credit the old-fashioned way. For instance, you can apply for secured loans, personal loans, or a home equity line of credit. A home equity line of credit makes sense if you have enough equity in your property because it is low-interest and often tax deductible.

You can also consider applying to credit unions if traditional lenders are not willing to lend you money because of your bad credit. A good point about credit unions is that they are often non-profit and you get a share of the earnings through lower fees on loans.

Now to the not-so-old-fashioned way, you might want to check out peer to peer lending services. P2P services allow you to borrow funds directly from an individual instead of institution lenders. However, you’ll be subject to high interest rates and the payment terms might be tough on your already shaky finances.

Find someone to consign a loan for you

Sometimes, people find themselves in a bad financial position due to factors beyond their control. Maybe you made an ill-timed investment decision, you misplaced a huge amount of money, or there was a financial emergency not covered by insurance. However, lenders are not likely to make subjective decisions on your loan applications. Hence, most lenders will take your bad credit as a sign that you are bad at managing money even though the reality is different.

However, friends and family members might be in a better position to understand why you have bad credit. More so, they are in a better position to trust your ability to repay the loan even though your bad credit score states otherwise. Hence, you can appeal to a family member or friend with a good credit to co-sign a loan with you.

Nonetheless, you should note that the creditor can hold the co-signer responsible for paying your loan if fail to pay up. More so, the payment history for the loan would be on your credit report and on that of the co-signer. Hence, you could make them liable to repay your debt and you could mess up their credit score if you default on the loan.

Ask family and friends for a loan

As a last resort, you might want to consider taking a loan from family and friends if all other options fail. However, you should be prepared for a degree of awkwardness if you are planning to ask for loans from family and friends. Once you are ready to live with the awkwardness, you can start by owning up and taking responsibility for your current financial woes and then highlighting your plan for getting your finances in order.

More so, you should be prepared to treat the loan as like a serious business transaction. Hence, you should offer to have the loan amount, repayment terms, and interest (if any) clearly and legally documented.

Treating a loan from family and friends like a serious business transaction will ease awkwardness and make it easier for people to lend you money even though you have bad credit. More so, a legally binding document will help you to see the loan as a loan and not a ‘gift’; hence, you are more inclined to pay it back and avoid the trap of a bad debt.

If you are looking to improve your credit, visit Crediful for more information

My friends don’t want to give me any loan. They thinks that I will not give them back. 😛 First two way is fit for me. 🙂

In our country it is not easy to get loan as you suggest. But thanks for this tips.